Support The Athenaeum of Philadelphia!

Help The Athenaeum fulfill its mission of nurturing curiosity in members and neighbors, strengthening community through learning and discourse by making a tax-deductible donation.

Click here to make a donation.

Help The Athenaeum fulfill its mission of nurturing curiosity in members and neighbors, strengthening community through learning and discourse by making a tax-deductible donation.

Click here to make a donation.

1814 Society

The 1814 Society provides essential, unrestricted support to The Athenaeum and directly impacts the organization’s wide range of programming, upkeep of our world-renowned collections and the stewardship of our historic National Landmark building on Washington Square.With a gift of $1,000+ above member dues, 1814 Society members receive the following benefits for a full year:

- Exclusive access to special events and receptions

- Intimate behind the scenes experiences with our Curator and Executive Director

- Personal invitations to Athenaeum symposia, exhibition preview parties, and tours

- Special recognition in our Annual Report

- Quarterly communications with updates exclusive to the 1814 Society

DONATE Menu

PLANNED GIVING

The Legacy Society recognizes supporters who have included The Athenaeum in their wills, trusts, retirement plans or other estate-planning arrangements. Join the Legacy Society and create a greater impact at The Athenaeum by completing a non-legally binding Letter of Intent, or by contacting Beth Hessel, Executive Director at (215)-925-2688.If you’ve already added The Athenaeum to your estate plan, please fill out our Legacy Society Donor Form to let us know. We would like to share our sincere thanks for your generosity by including you in the Legacy Society.

Legacy Society members also have access to all of the same benefits of 1814 Society members.

*Before making a contribution, please consult your financial and legal advisors to determine which kind of gift is the best fit for you.

Planned Giving Opportunities

Bequests are a great way to make a difference at The Athenaeum without changing the way that you live your life today. Charitable bequests qualify for a full charitable deduction for estate tax purposes.

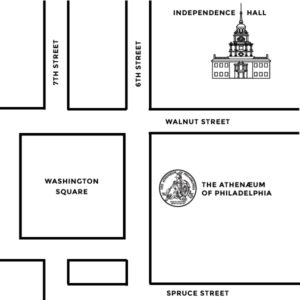

You can use the following language when making your bequest, “I give The Athenaeum of Philadelphia, now located at 219 S 6th Street, Philadelphia, Pennsylvania [a percentage of the estate or a specific dollar amount] to be used for its general support and charitable purposes without restriction.”

You can use the following language when making your bequest, “I give The Athenaeum of Philadelphia, now located at 219 S 6th Street, Philadelphia, Pennsylvania [a percentage of the estate or a specific dollar amount] to be used for its general support and charitable purposes without restriction.”

Making a planned gift through a life insurance policy or retirement account offers a meaningful way to support The Athenaeum with minimal legal complexity. Consider naming The Athenaeum as the beneficiary of accounts including IRAs, 401(k)s, and 403(b)s. Since retirement plans and life insurance policies are often heavily taxed, designating The Athenaeum as the beneficiary means the remaining funds upon your death avoid hidden income or estate taxes, removing potential tax burdens for your loved ones.

If you wish to support The Athenaeum in a meaningful way, but want to retain interest in your property for your benefit, a Charitable Remainder Trust might be a good option for you. You’ll receive an immediate charitable deduction for a portion of the gift when you itemize deductions on federal income tax return.

You’ll also receive annual payments for life, a portion of the payments will be tax free for a period of years. Your estate may have the opportunity to enjoy lower probate costs and federal estate tax.

Menu

ADDITIONAL WAYS TO GIVE

Support The Athenaeum through an unrestricted gift to our Annual Fund. These donations support our annual operating expenses, ensuring that The Athenaeum has the flexibility to respond to the immediate needs of our National Historic Landmark Building, collections, staffing, and more!

Click here to donate.

Click here to donate.

Donor-advised funds (DAFs) are charitable investment accounts that give donors the opportunity to make contributions to charitable organizations – like The Athenaeum – to receive an immediate tax deduction. DAFs are the fastest growing charitable giving vehicle in the US. They’re a great way to donate assets that charities often can’t accept as a gift directly such as restricted stock, Bitcoin and other cryptocurrencies, cash equivalents, and publicly traded securities or mutual fund shares.

*Please note that The Athenaeum cannot accept DAF payments for membership dues as our memberships are not considered tax-deductible donations by law.

*Please note that The Athenaeum cannot accept DAF payments for membership dues as our memberships are not considered tax-deductible donations by law.

If you’re 70½ or older, you have the ability to donate up to $100,000 per tax year through your Individual Retirement Account (IRA). Qualified Charitable Distributions (QCDs) count toward your required minimum distribution for the year.

Making a gift of stock or securities may help you maximize your charitable giving and minimize the taxes you pay on capital gains. If you’d like to support The Athenaeum through gifts of stock or securities, email Beth Hessel (bhessel@philaathenaeum.org) to learn more.

Bookcase Restoration Fund

The Reading Room boasts 20 bays of bookcases and 11 bookcases on the Mezzanine. The cost to repair and restore one bay of bookcases is $11,000. To repair all of the bookcases over time will cost nearly $270,000. Designed by John Notman, the Reading Room bookcases, with their distinctive faux bois finish and leaded glass, contribute significantly to the room’s elegance.

However, after 178 years and some less-than-ideal repairs, they are showing their age. This project aims to bring the bookcases back to their original condition, enhancing their 19th-century design while improving their stability, security, and ease of use.

Be a Part of The Athenaeum’s Legacy

Name a bookshelf with a donation of $1,000

Name a bay with a donation of $11,000

Click here to donate.

The Reading Room boasts 20 bays of bookcases and 11 bookcases on the Mezzanine. The cost to repair and restore one bay of bookcases is $11,000. To repair all of the bookcases over time will cost nearly $270,000. Designed by John Notman, the Reading Room bookcases, with their distinctive faux bois finish and leaded glass, contribute significantly to the room’s elegance.

However, after 178 years and some less-than-ideal repairs, they are showing their age. This project aims to bring the bookcases back to their original condition, enhancing their 19th-century design while improving their stability, security, and ease of use.

Be a Part of The Athenaeum’s Legacy

Name a bookshelf with a donation of $1,000

Name a bay with a donation of $11,000

Click here to donate.

Workplace giving is an easy way to support The Athenaeum! Some employers will even match your charitable contributions. Contact your Human Resource Department to learn more about your contribution and matching benefits.

Support The Athenaeum with a sponsorship for one of our exhibitions or programs. Sponsors receive visibility in print, online, and during the program. Email Beth Hessel (bhessel@philaathenaeum.org) to learn more.

DONATE Menu